Key features and settings

Relative close represents position of bar's close relative to high and low, high of bar being 100% and low of bar being 0%. Relative close indicates strength of bulls/bears in a given bar, the higher the better for bulls, the lower the better for bears.

Relative volatility (bar range, high - low) and relative volume are presented in a form of a multiplier, relative to their respective moving averages (SMA 20). A value of 1x indicates volume/volatility being on par with moving average, 2x indicates volume/volatility being twice as much as moving average and so on. Relative volume and volatility can be used for measuring general market participant interest, the "weight of the bar" as it were.

Users can gauge past bar metrics using lookback via input menu. Past bars, especially recent ones, are helpful for giving context for current bar metrics. Lookback bars are highlighted on the chart using a yellow box and metrics presented on the data dashboard with lookback symbols:

To inspect bar metric data and its implications, users can highlight bars with specified bracket values for each metric:

When bar highlighter is toggled on and desired bar metric values set, alert for the specified combination can be toggled on via alert menu. Note that bar highlighter must be enabled in order for alerts to function.

Key features and settings

Relative close represents position of bar's close relative to high and low, high of bar being 100% and low of bar being 0%. Relative close indicates strength of bulls/bears in a given bar, the higher the better for bulls, the lower the better for bears.

Relative volatility (bar range, high - low) and relative volume are presented in a form of a multiplier, relative to their respective moving averages (SMA 20). A value of 1x indicates volume/volatility being on par with moving average, 2x indicates volume/volatility being twice as much as moving average and so on. Relative volume and volatility can be used for measuring general market participant interest, the "weight of the bar" as it were.

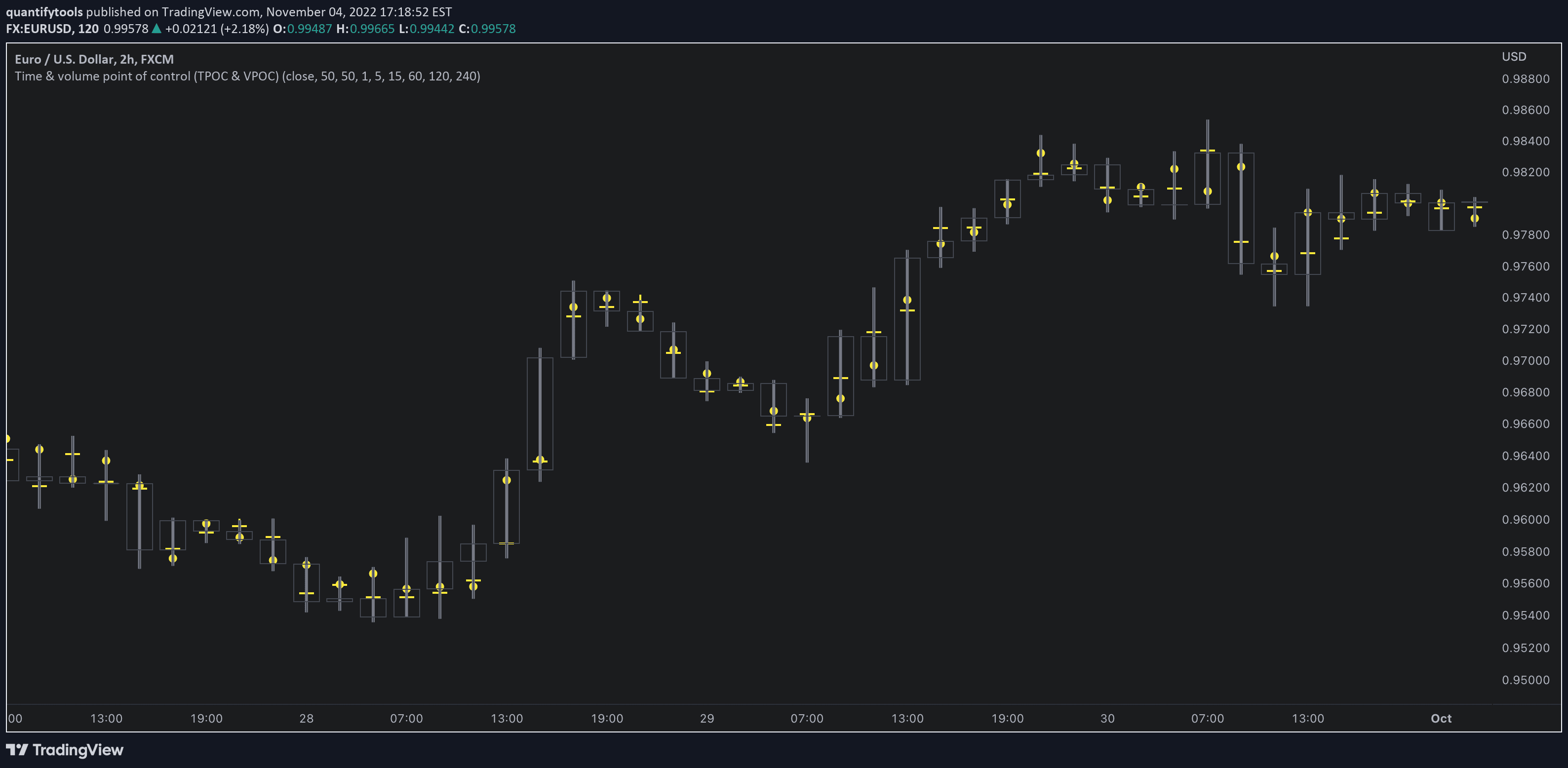

Users can gauge past bar metrics using lookback via input menu. Past bars, especially recent ones, are helpful for giving context for current bar metrics. Lookback bars are highlighted on the chart using a yellow box and metrics presented on the data dashboard with lookback symbols:

To inspect bar metric data and its implications, users can highlight bars with specified bracket values for each metric:

When bar highlighter is toggled on and desired bar metric values set, alert for the specified combination can be toggled on via alert menu. Note that bar highlighter must be enabled in order for alerts to function.

Visual settings

Bar metric dots are gradient colored the following way:

Relative volatility & volume

0x -> 1x / Neutral (white) -> Light (yellow)

1x -> 1.7x / Light (yellow) -> Medium (orange)

1.7x -> 2.4x / Medium (orange) -> Heavy (red)

Relative close

0% -> 25% / Heavy bearish (red) -> Light bearish (dark red)

25% -> 45% / Light bearish (dark red) -> Neutral (white)

45% - 55% / Neutral (white)

55% -> 75% / Neutral (white) -> Light bullish (dark green)

75% -> 100% / Light bullish (dark green) -> Heavy bullish (green)

All colors can be adjusted via input menu. Label size, label distance from bar (offset) and text format (regular/stealth) can be adjusted via input menu as well:

Visual settings

Bar metric dots are gradient colored the following way:

Relative volatility & volume

0x -> 1x / Neutral (white) -> Light (yellow)

1x -> 1.7x / Light (yellow) -> Medium (orange)

1.7x -> 2.4x / Medium (orange) -> Heavy (red)

Relative close

0% -> 25% / Heavy bearish (red) -> Light bearish (dark red)

25% -> 45% / Light bearish (dark red) -> Neutral (white)

45% - 55% / Neutral (white)

55% -> 75% / Neutral (white) -> Light bullish (dark green)

75% -> 100% / Light bullish (dark green) -> Heavy bullish (green)

All colors can be adjusted via input menu. Label size, label distance from bar (offset) and text format (regular/stealth) can be adjusted via input menu as well:

How to use Bar metrics in trading

As interpretation of bar metrics is highly contextual, it is especially important to use other means in conjunction with the metrics. Levels, oscillators, moving averages, whatever you have found useful for your process. In short, relative close indicates directional bias and relative volume/volatility indicates "weight" of directional bias.

Bullish interpretations

High relative close, low relative volume/volatility = mildly bullish, bias up/consolidation

High relative close, medium relative volume/volatility = bullish, bias up

High relative close, high relative volume/volatility = exuberantly bullish, bias up/down depending on context

Neutral interpretations

Medium relative close, low relative volume/volatility = noise, no bias

Medium relative close, medium to high relative volume/volatility = indecision, further evidence needed to evaluate bias

Bearish interpretations

Low relative close, low relative volume/volatility = mildly bearish, bias down/consolidation

Low relative close, medium relative volume/volatility = bearish, bias down

Low relative close, high relative volume/volatility = exuberantly bearish, bias down/up depending on context

Nuances & considerations

As to relative close, it's important to note that each bar is a trading range when viewed on a lower timeframe, ES 1W vs. ES 4H:

When relative close is high, bulls were able to push price to range high by the time of close. When relative close is low, bears were able to push price to range low by the time of close. In other words, bulls/bears were able to gain the upper hand over a given trading range, hinting strength for the side that made the final push. When relative close is around middle range (40-60%), it can be said neither side is clearly dominating the range, hinting neutral/indecision bias from a relative close perspective.

As to relative volume/volatility, low values (less than ~0.7x) imply bar has low market participant interest and therefore is likely insignificant, as it is "lacking weight". Values close to or above 1x imply meaningful market participant interest, whereas values well above 1x (greater than ~1.3x) imply exuberance. This exuberance can manifest as initiation (beginning of a trend) or as exhaustion (end of a trend)

Detecting trend initiations and reversals

Bar metrics is best suited for detecting anomalies in price and volume, often being inflection points for trend initiation and reversals.

How to use Bar metrics in trading

As interpretation of bar metrics is highly contextual, it is especially important to use other means in conjunction with the metrics. Levels, oscillators, moving averages, whatever you have found useful for your process. In short, relative close indicates directional bias and relative volume/volatility indicates "weight" of directional bias.

Bullish interpretations

High relative close, low relative volume/volatility = mildly bullish, bias up/consolidation

High relative close, medium relative volume/volatility = bullish, bias up

High relative close, high relative volume/volatility = exuberantly bullish, bias up/down depending on context

Neutral interpretations

Medium relative close, low relative volume/volatility = noise, no bias

Medium relative close, medium to high relative volume/volatility = indecision, further evidence needed to evaluate bias

Bearish interpretations

Low relative close, low relative volume/volatility = mildly bearish, bias down/consolidation

Low relative close, medium relative volume/volatility = bearish, bias down

Low relative close, high relative volume/volatility = exuberantly bearish, bias down/up depending on context

Nuances & considerations

As to relative close, it's important to note that each bar is a trading range when viewed on a lower timeframe, ES 1W vs. ES 4H:

When relative close is high, bulls were able to push price to range high by the time of close. When relative close is low, bears were able to push price to range low by the time of close. In other words, bulls/bears were able to gain the upper hand over a given trading range, hinting strength for the side that made the final push. When relative close is around middle range (40-60%), it can be said neither side is clearly dominating the range, hinting neutral/indecision bias from a relative close perspective.

As to relative volume/volatility, low values (less than ~0.7x) imply bar has low market participant interest and therefore is likely insignificant, as it is "lacking weight". Values close to or above 1x imply meaningful market participant interest, whereas values well above 1x (greater than ~1.3x) imply exuberance. This exuberance can manifest as initiation (beginning of a trend) or as exhaustion (end of a trend)

Detecting trend initiations and reversals

Bar metrics is best suited for detecting anomalies in price and volume, often being inflection points for trend initiation and reversals.

Get Bar metrics on TradingView

Find TradingView indicators easily by opening up any chart on TradingView (e.g. TSLA) and clicking Indicators tab on top menu. To find all our tools, search "quantifytools" and click an indicator to add to your chart.

TradingView page

Bar Metrics on TradingView ↗

Get Bar metrics on TradingView

Find TradingView indicators easily by opening up any chart on TradingView (e.g. TSLA) and clicking Indicators tab on top menu. To find all our tools, search "quantifytools" and click an indicator to add to your chart.

TradingView page

Bar Metrics on TradingView ↗