What is Volume Footprint?

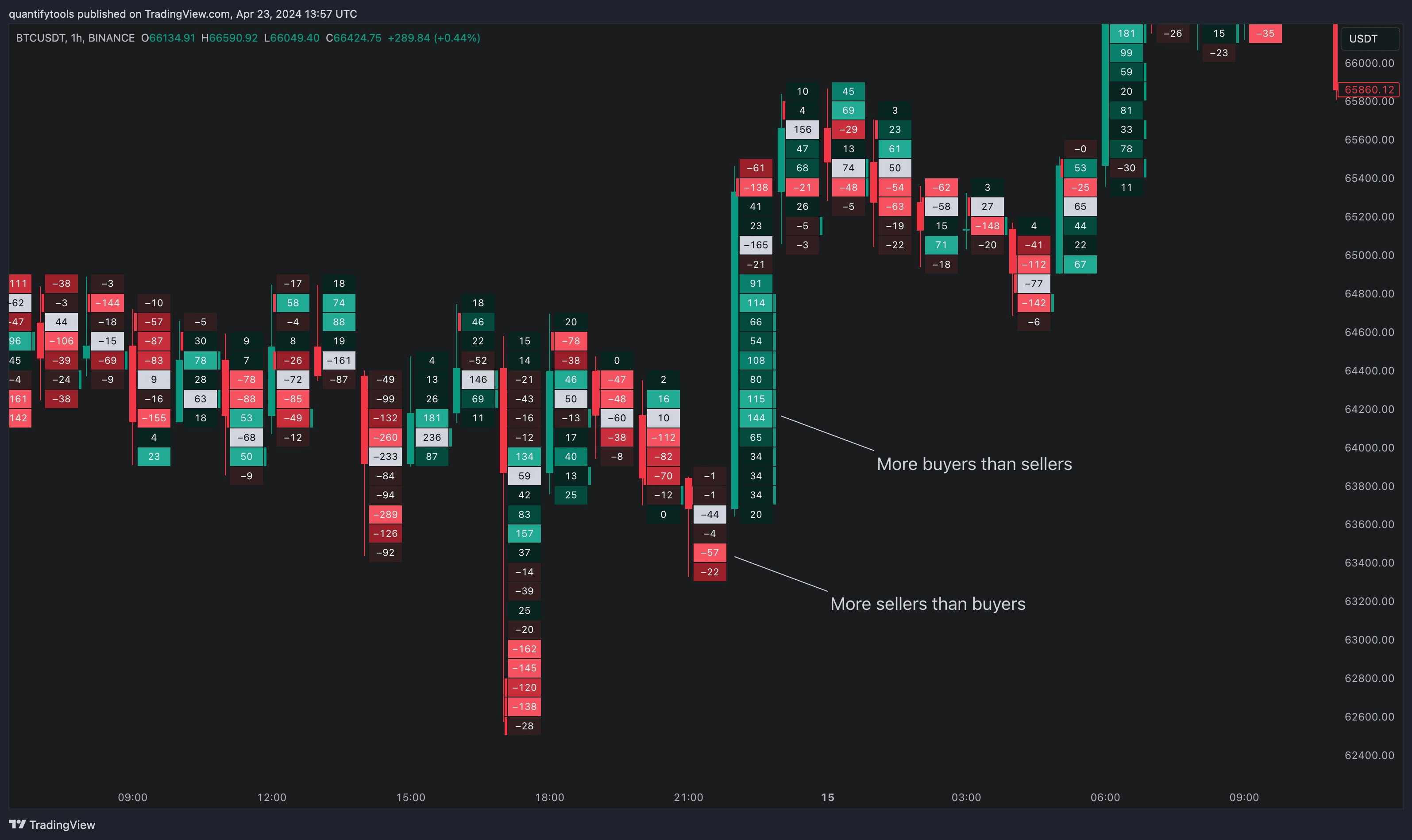

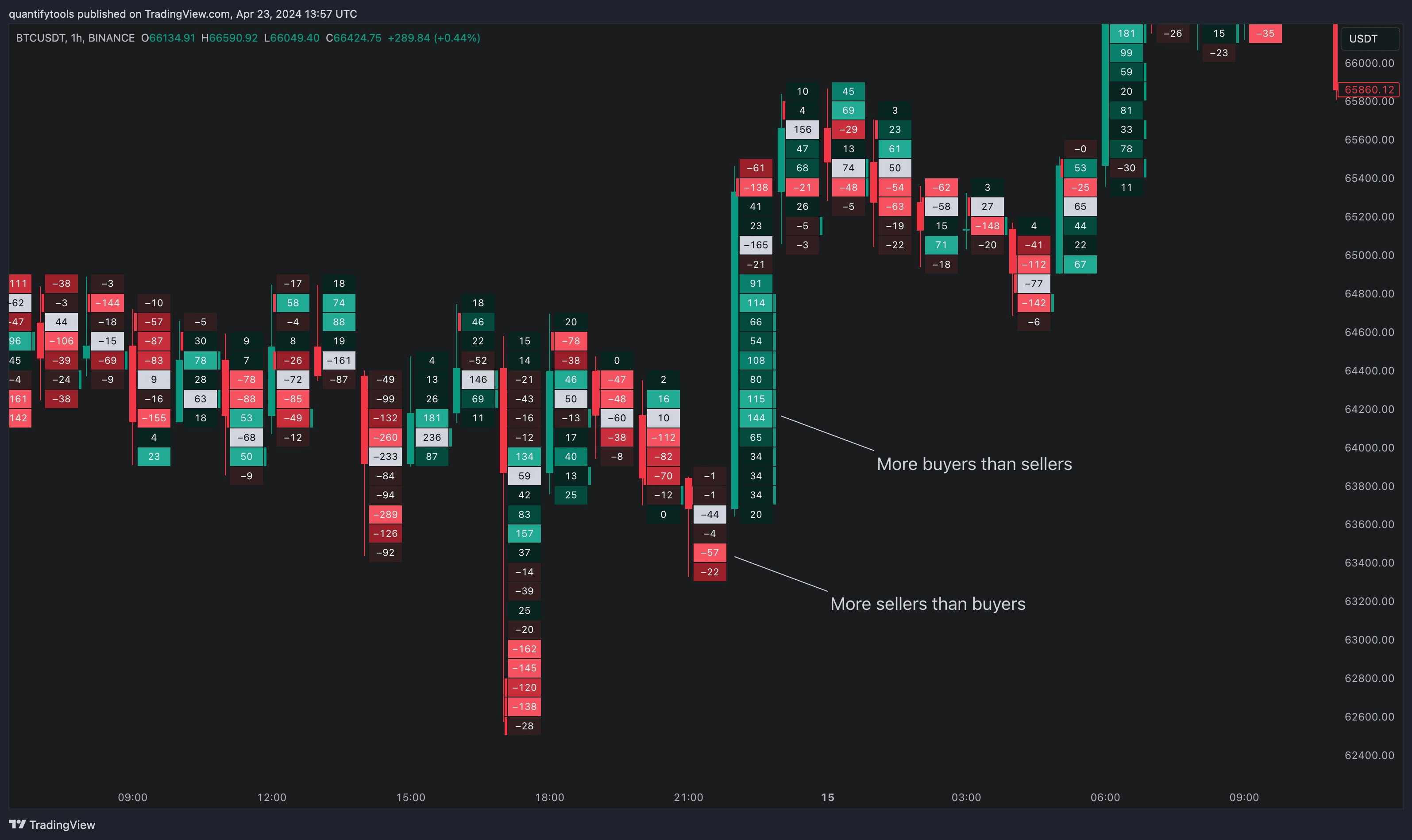

Footprint is a highly useful orderflow tool showing volume traded at different price levels as well as which side dominated in amount of volume (buyers or sellers), a concept known as volume delta.

Where to find Volume Footprint on TradingView?

1. Open any chart

2. Click candle icon at top menu (next to Indicators)

3. Select Volume footprint

Note that this is only available for Premium plans currently.

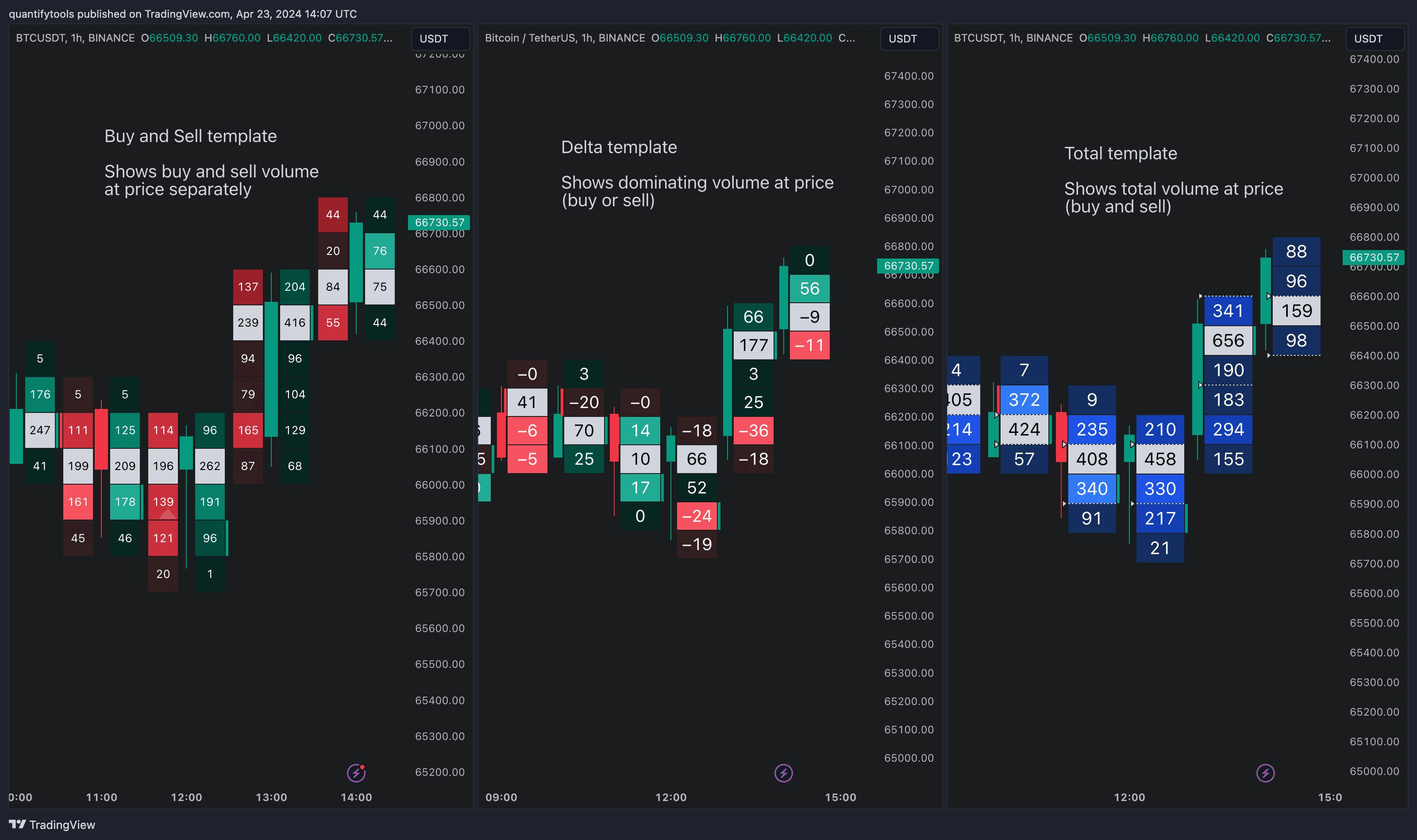

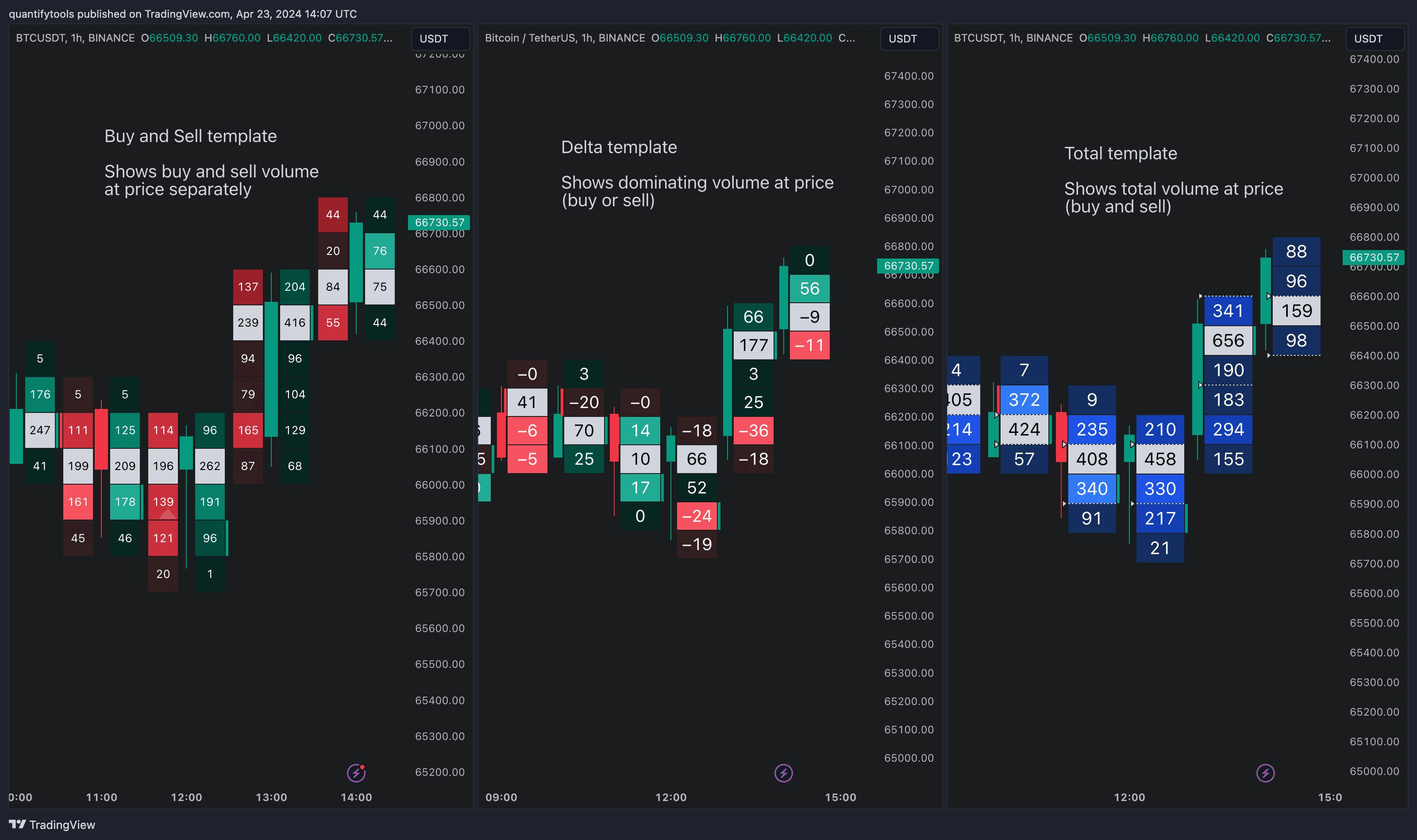

Templates

1. Buy and sell - shows buy and sell volume at price side by side

2. Delta - shows dominating volume at price (buy volume - sell volume)

3. Total - shows total volume at price (buy volume + sell volume)

What is Volume Footprint?

Footprint is a highly useful orderflow tool showing volume traded at different price levels as well as which side dominated in amount of volume (buyers or sellers), a concept known as volume delta.

Where to find Volume Footprint on TradingView?

1. Open any chart

2. Click candle icon at top menu (next to Indicators)

3. Select Volume footprint

Note that this is only available for Premium plans currently.

Templates

1. Buy and sell - shows buy and sell volume at price side by side

2. Delta - shows dominating volume at price (buy volume - sell volume)

3. Total - shows total volume at price (buy volume + sell volume)

Features and settings of Volume Footprint

Let's unpack a bit what goes into Volume Footprint and what's happening under the hood.

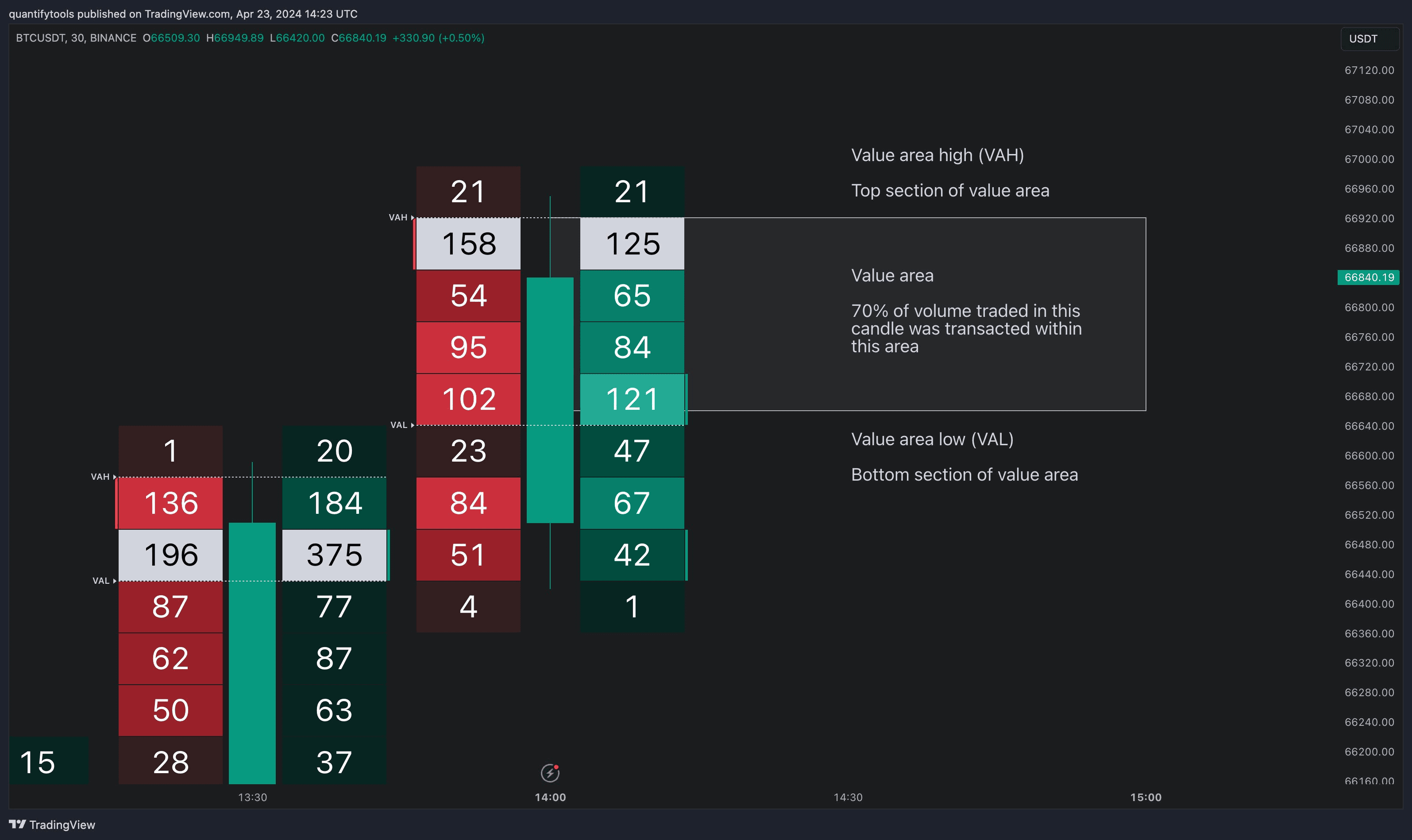

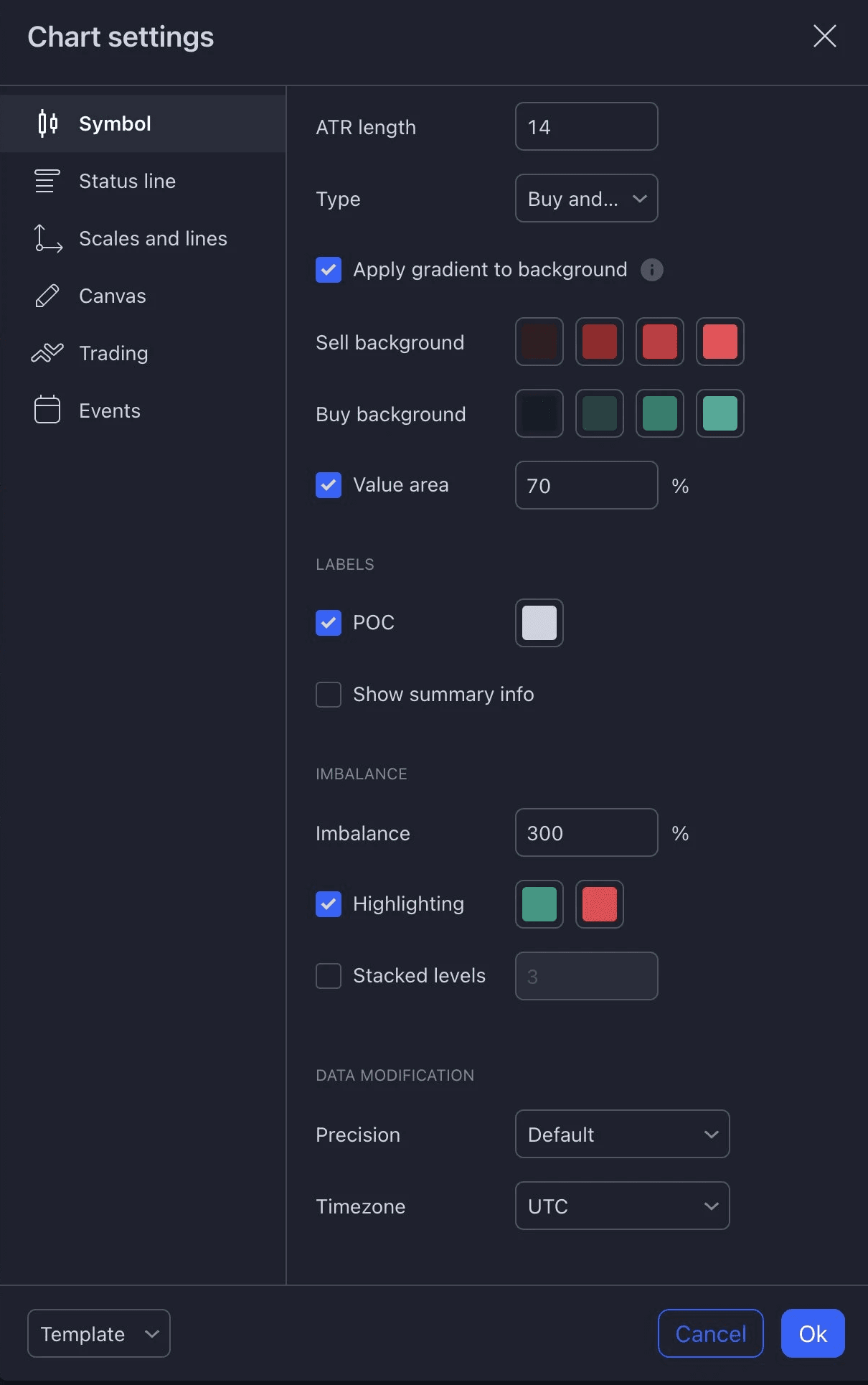

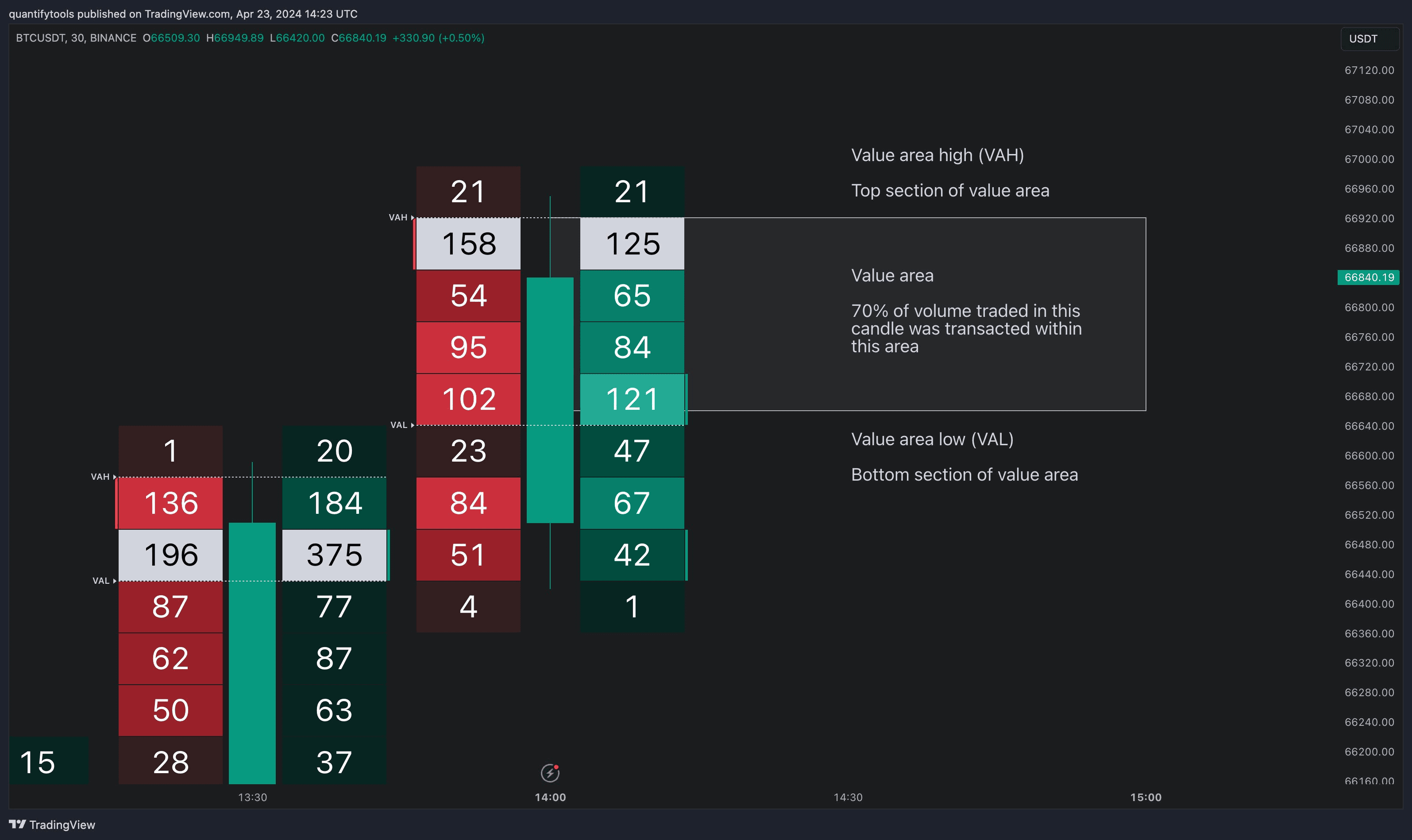

Value area

Area where most amount of volume is traded within the candle (by default defined by 70% of total volume). Visualized using VAL-VAH lines on left side.

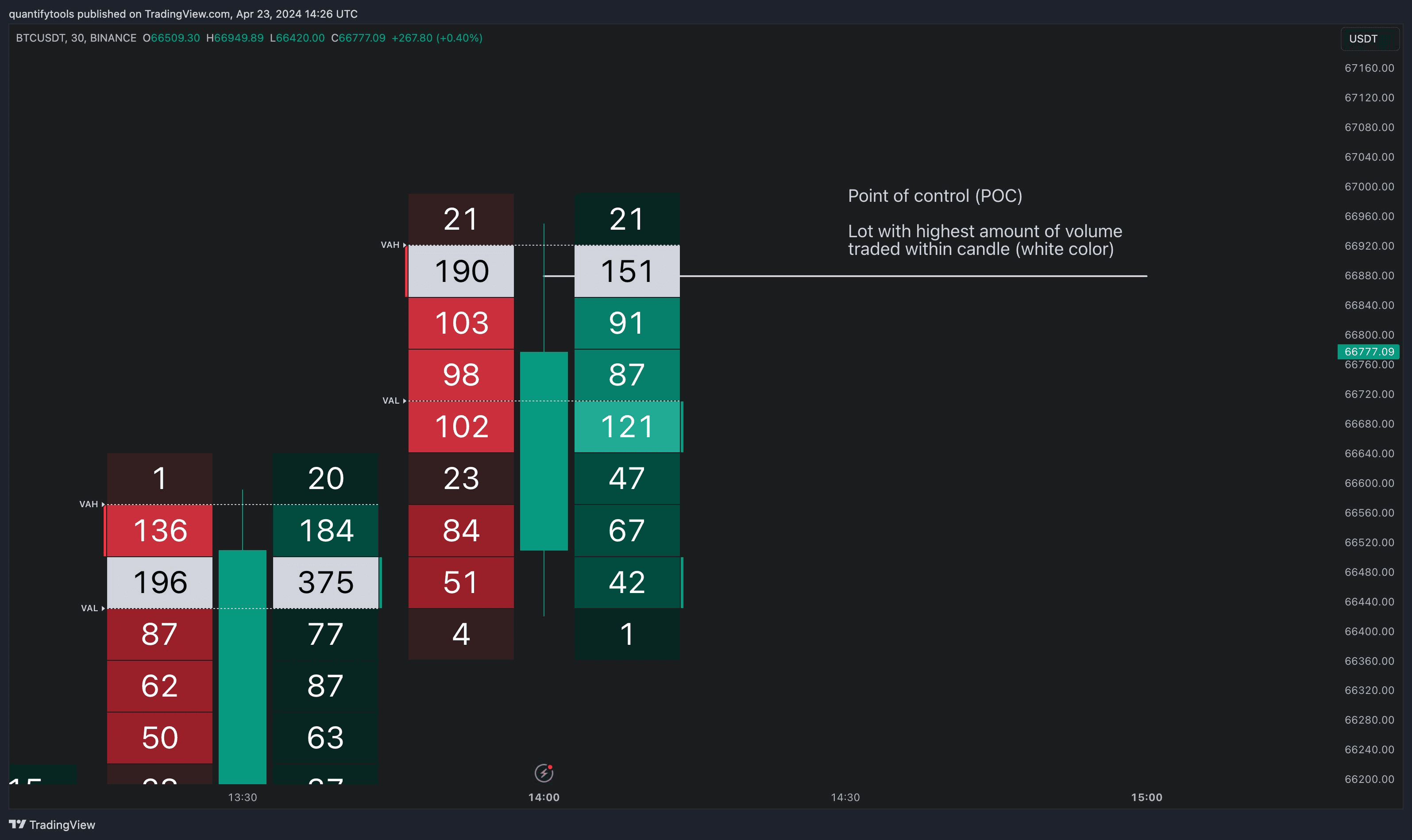

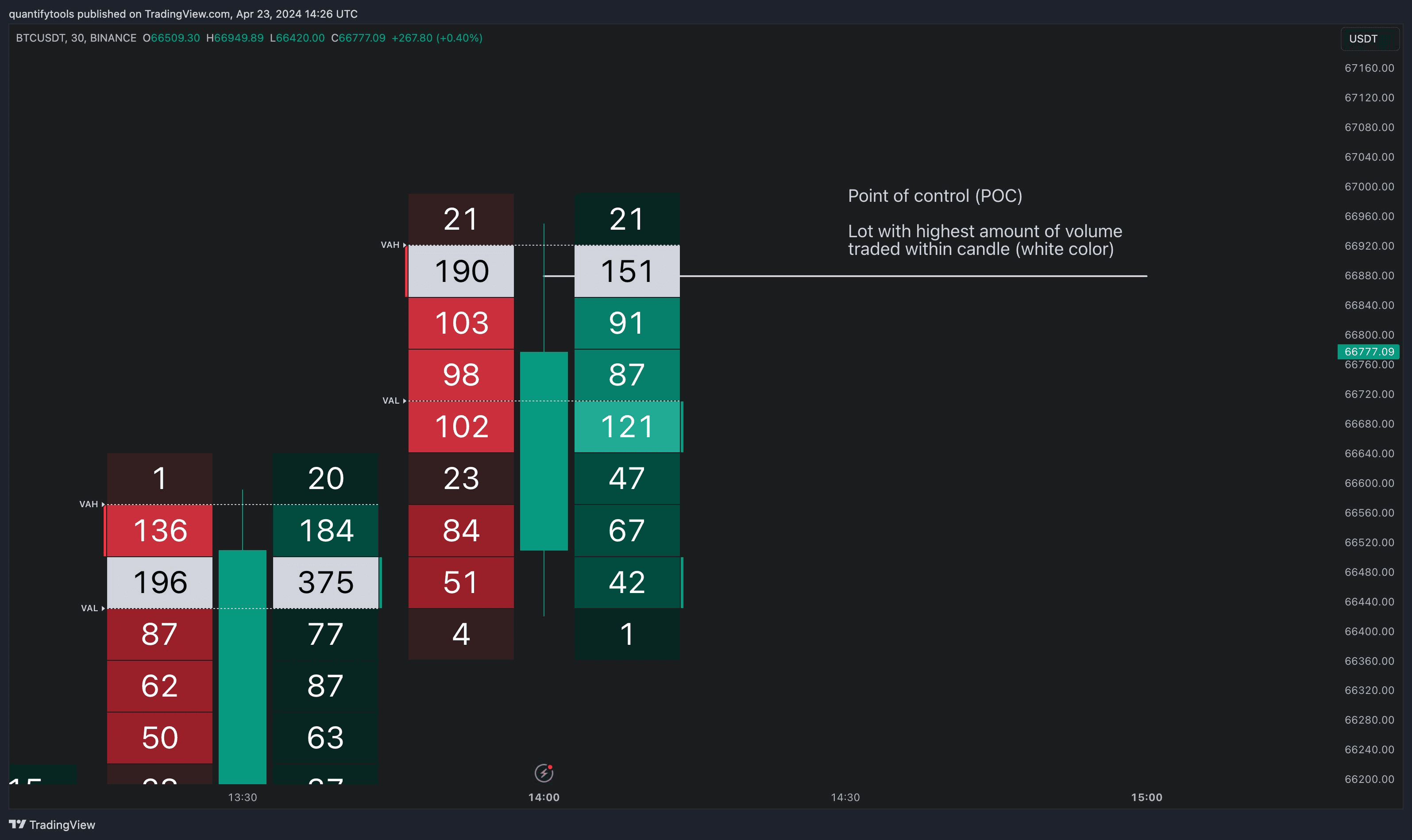

Point of control (POC)

Lot with highest amount of volume traded within the candle (individual lot, not an area of multiple lots like value area). Visualized using white color.

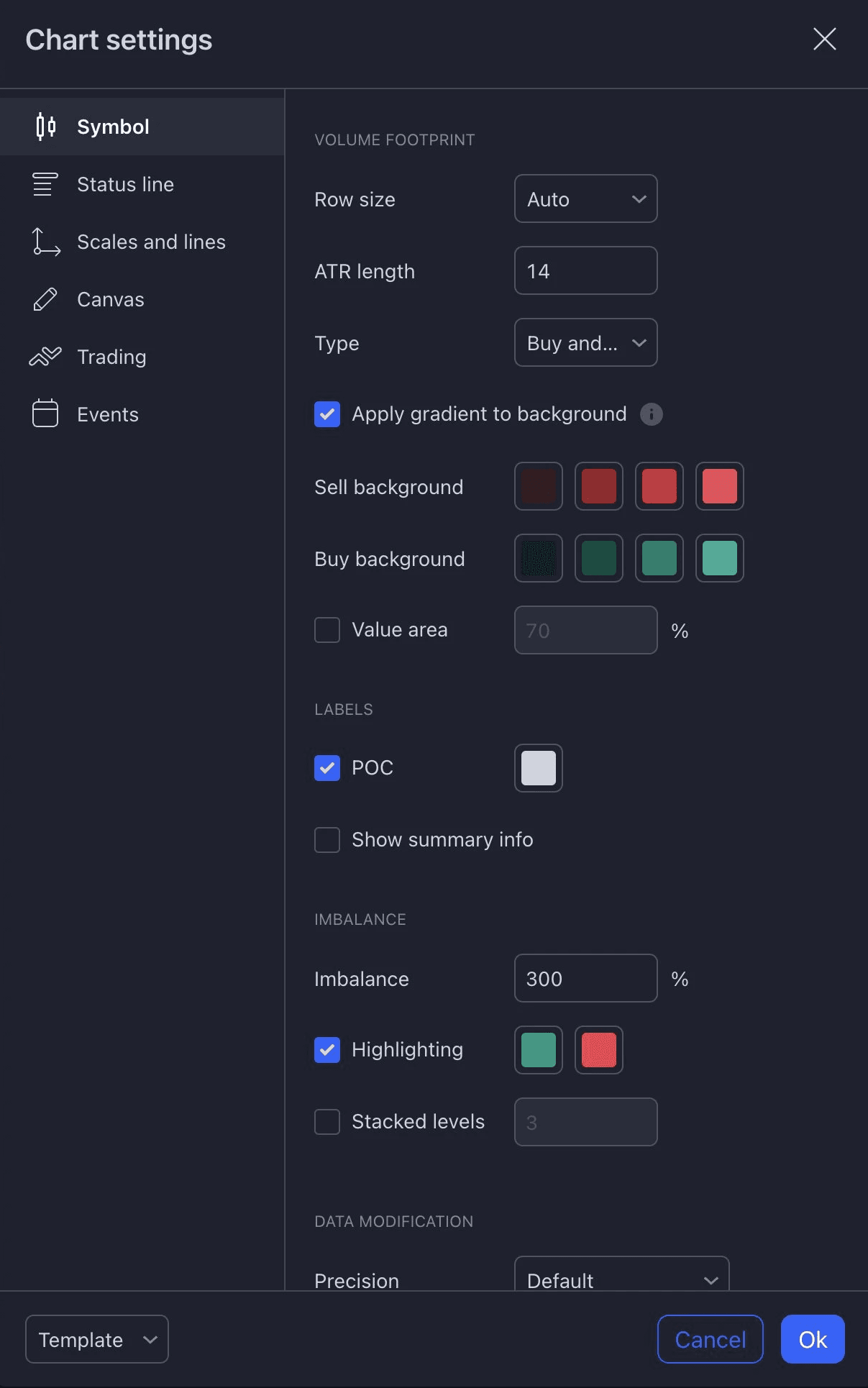

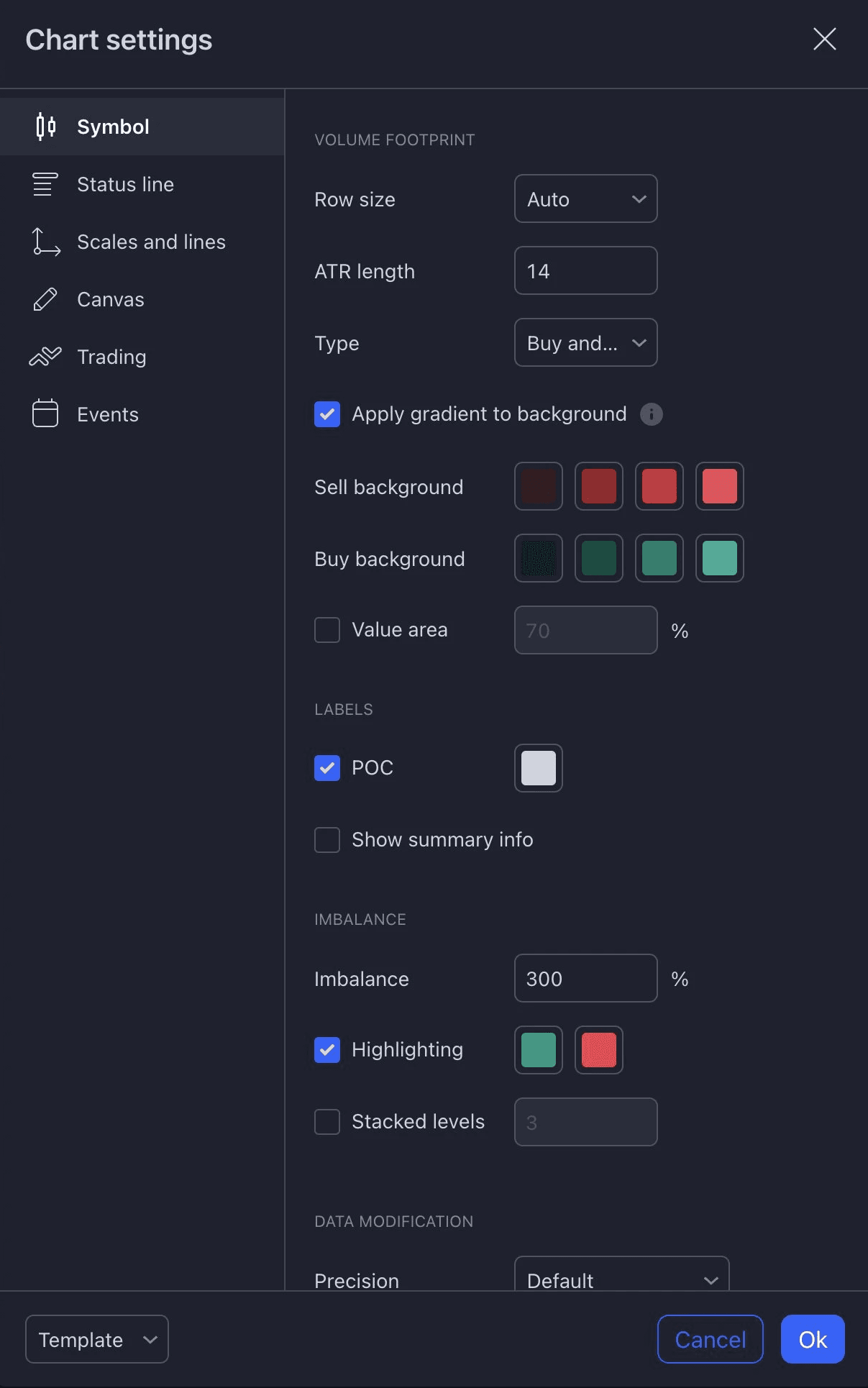

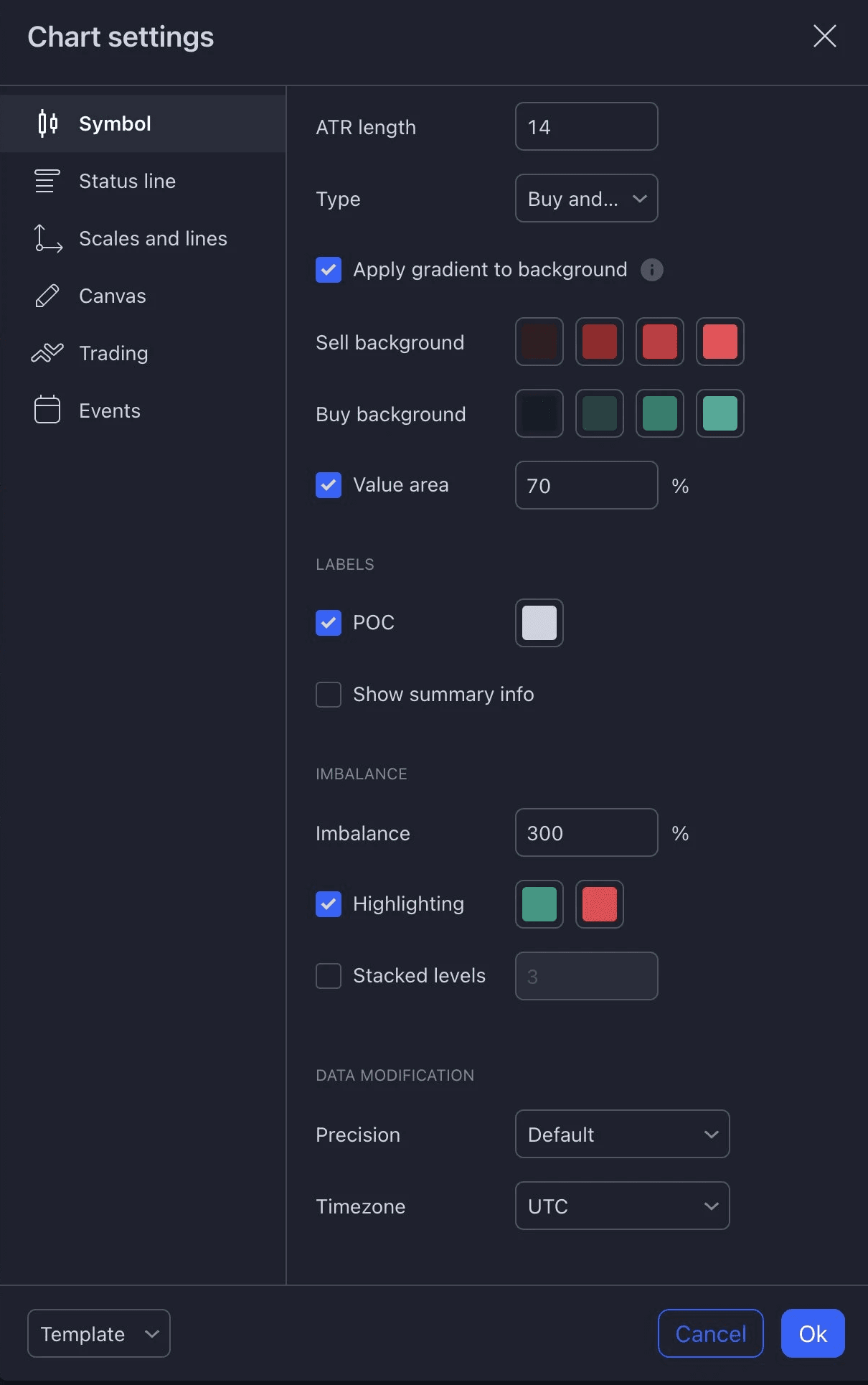

Settings

Row size - Controls size of lots where volume values are aggregated. By default automatic, can also be specified in ticks.

ATR length - Controls behavior of automatic sizing

Type - Determines template

Gradient color - On/off color based on magnitude of volume

Value area - Percentage of total volume traded to define a value area

POC - On/off and color for POC visuals

Summary info - Adds label stating total volume values based on all lots

Imbalance - % of mismatch between buy/sell volume to define an imbalance

Features and settings of Volume Footprint

Let's unpack a bit what goes into Volume Footprint and what's happening under the hood.

Value area

Area where most amount of volume is traded within the candle (by default defined by 70% of total volume). Visualized using VAL-VAH lines on left side.

Point of control (POC)

Lot with highest amount of volume traded within the candle (individual lot, not an area of multiple lots like value area). Visualized using white color.

Settings

Row size - Controls size of lots where volume values are aggregated. By default automatic, can also be specified in ticks.

ATR length - Controls behavior of automatic sizing

Type - Determines template

Gradient color - On/off color based on magnitude of volume

Value area - Percentage of total volume traded to define a value area

POC - On/off and color for POC visuals

Summary info - Adds label stating total volume values based on all lots

Imbalance - % of mismatch between buy/sell volume to define an imbalance

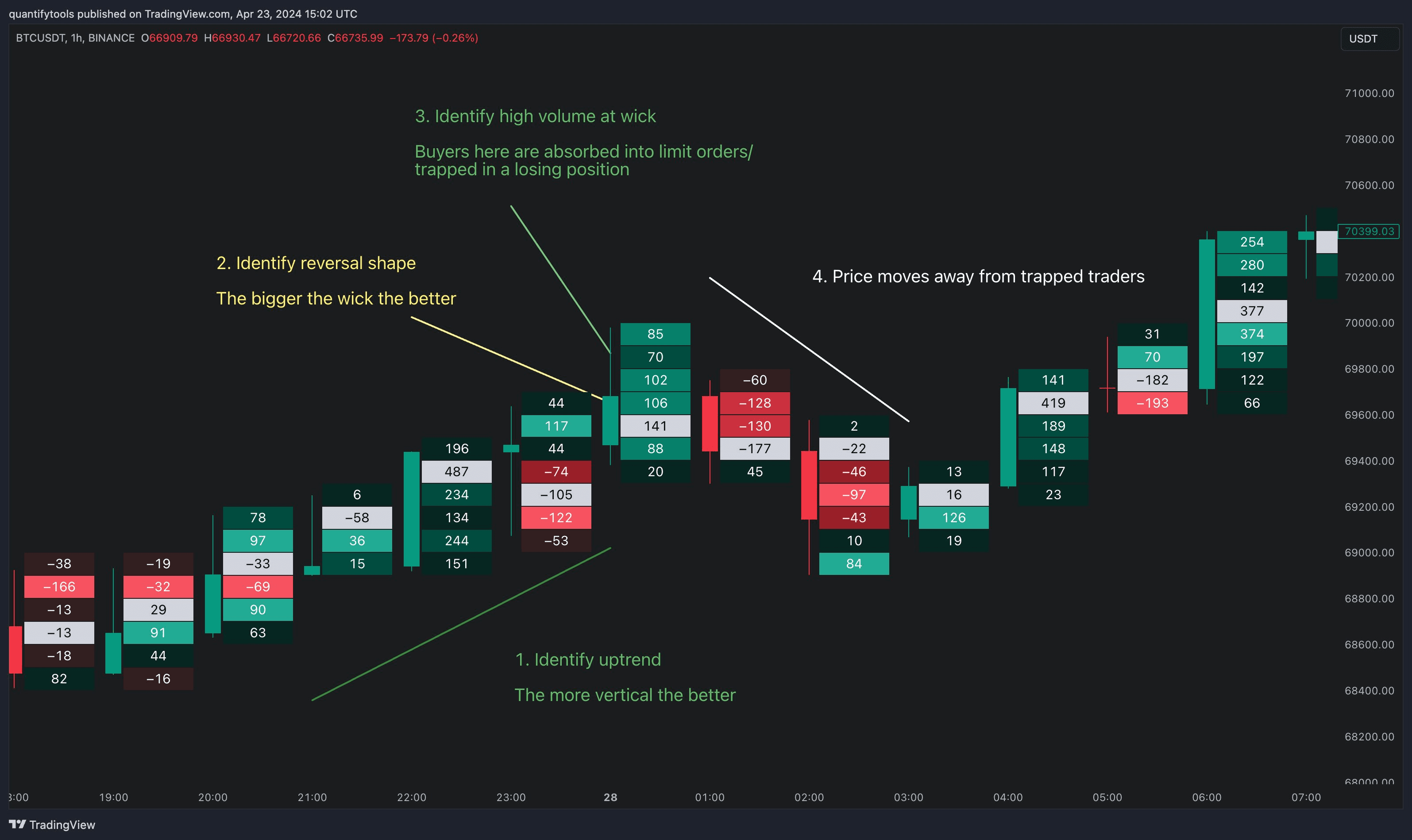

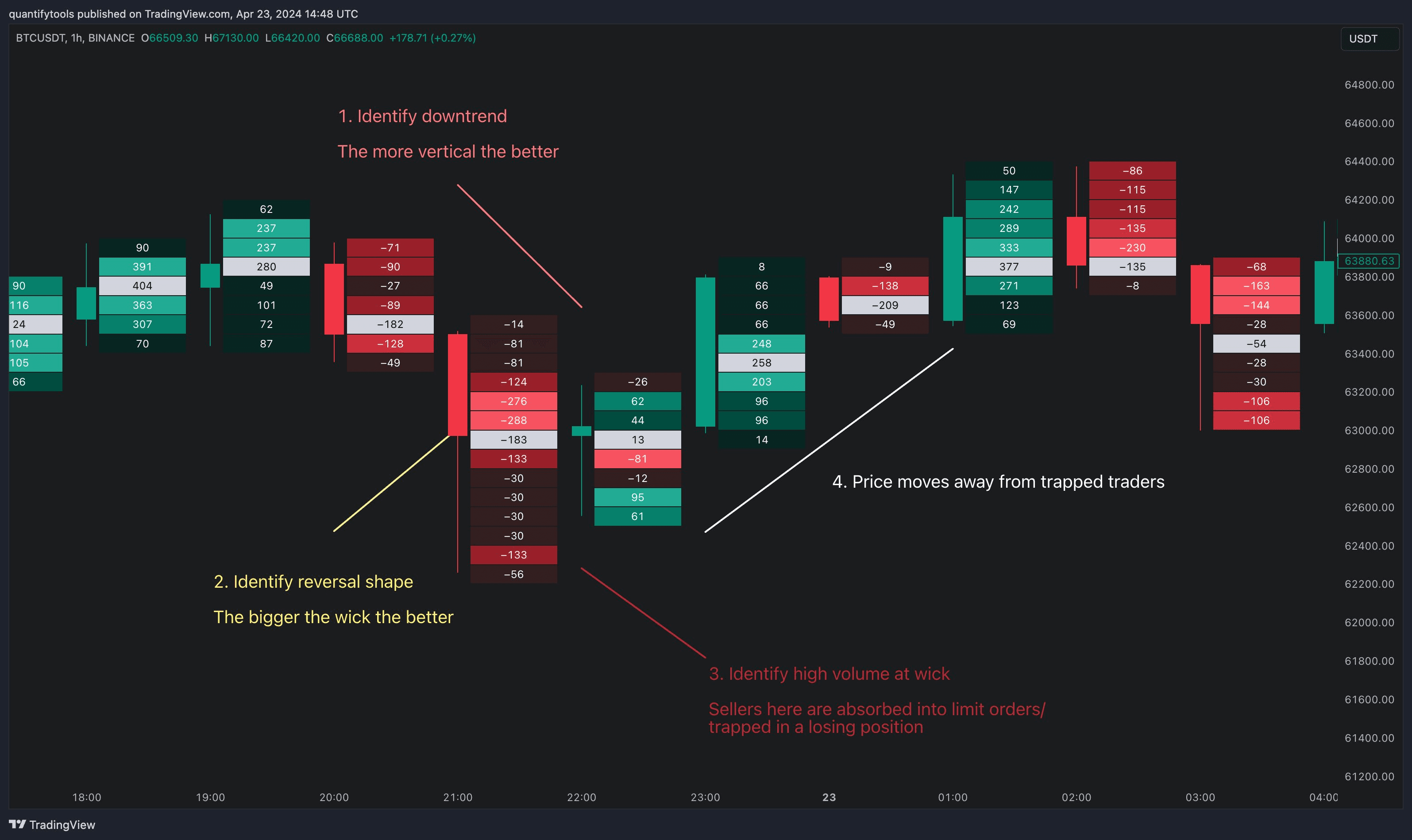

How to use Volume Footprint

A simple, easy to spot and highly effective way to detect reversals is spotting trapped traders. This concept is also known as absorption.

Here's the criteria:

Well established trend

Reversal shaped candle

High volume at wick

Detecting Trapped sellers using Volume footprint

Idea here is spotting poorly positioned traders, often due to a forced unwinding of positions into limit orders that absorb all the incoming pressure. This is a great sign of price finding deep liquidity

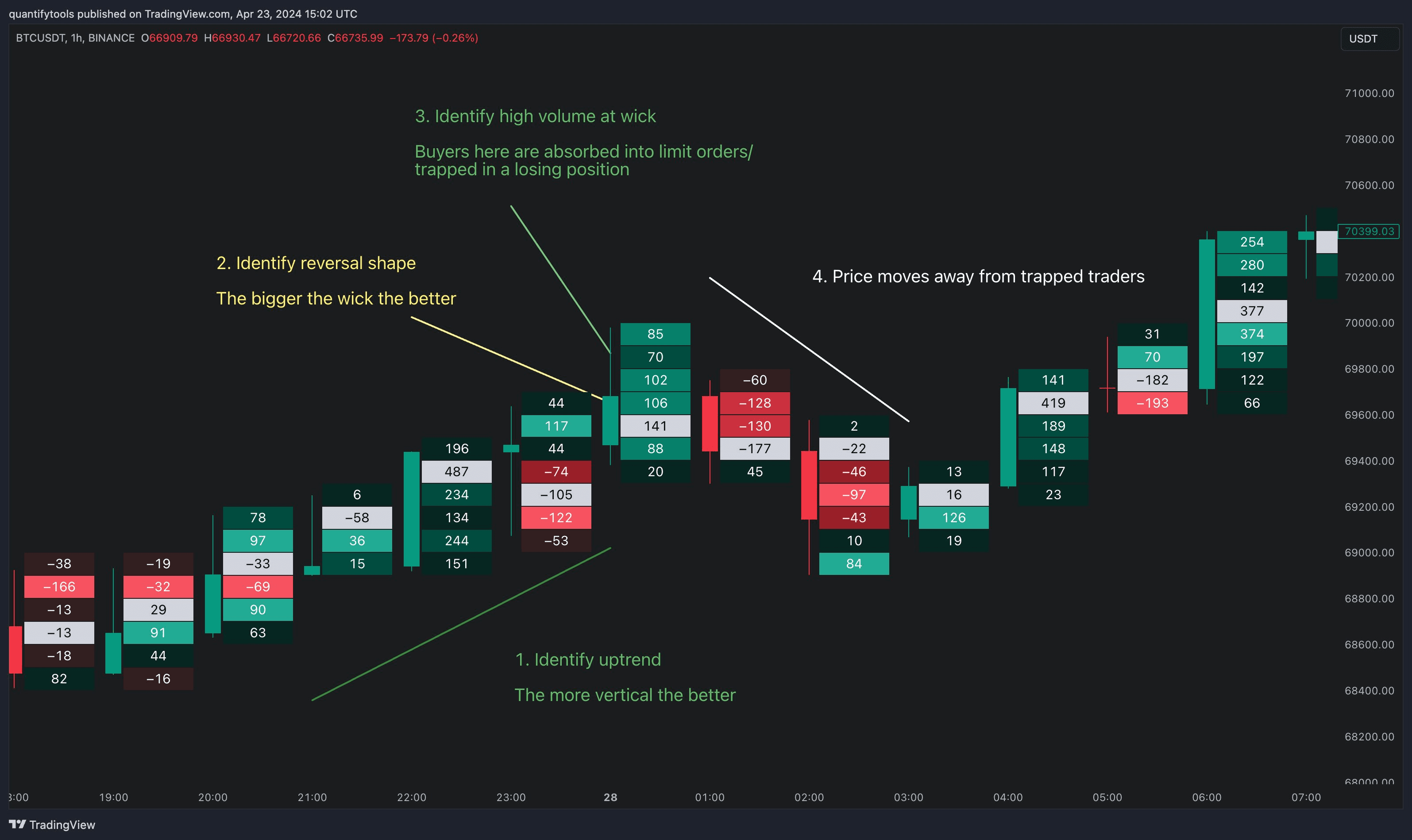

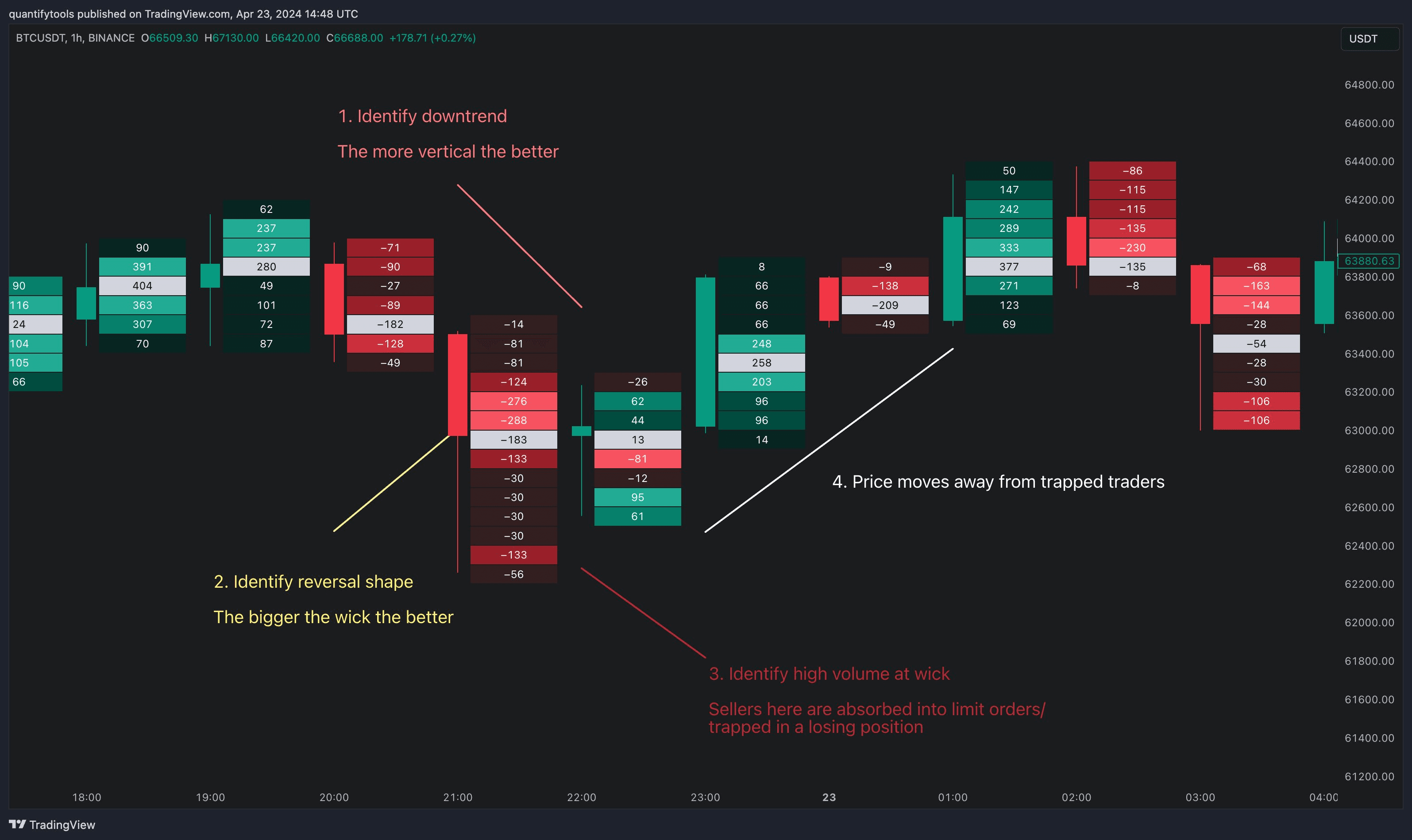

Detecting Trapped buyers using Volume footprint

Same is true for trapped buyers, but the other way around with an established uptrend and high volume at wick highs.

How to use Volume Footprint

A simple, easy to spot and highly effective way to detect reversals is spotting trapped traders. This concept is also known as absorption.

Here's the criteria:

Well established trend

Reversal shaped candle

High volume at wick

Detecting Trapped sellers using Volume footprint

Idea here is spotting poorly positioned traders, often due to a forced unwinding of positions into limit orders that absorb all the incoming pressure. This is a great sign of price finding deep liquidity

Detecting Trapped buyers using Volume footprint

Same is true for trapped buyers, but the other way around with an established uptrend and high volume at wick highs.